Introduction

The 21st century will most certainly be remembered in history as the century that witnessed the rapid democratization and commercialization of space towards a sustainable interplanetary society. Whereas the past century was undoubtedly marked by historic, pioneering, and foundational scientific and technological achievements in space (of which there are too many to list), the 21st century is already making its own unique mark on space exploration history with the rapid democratization and commercialization of space. Until only a few decades ago, space was the exclusive domain of large sovereign nations or federations such as the USA, Russia (USSR), China, India, Japan, or the European Space Agency (ESA). They were the only countries who could set aside significant resources to invest in space. In all of these countries, the implementation of space missions was either at government-owned facilities or at large government prime contractors. In the US, some of the recipients of large government system contracts have been Lockheed Martin (LM), Boeing, or Northrop Grumman Corporation.

NASA Artemis Program, Figure Courtesy of NASA

Today, the commercial space ecosystem in the USA is very different and more vibrant than at any time in the past. In 2000, Jeff Bezos founded Blue Origin, in 2002 Elon Musk founded SpaceX, and in 2004 Richard Branson founded

Virgin Galactic (in 2017 he founded Virgin Orbit). Together with hundreds of smaller space start-up companies in the US and around the world, this new generation of commercial providers of access to space and space services is

generally referred to as New Space. As evidence of the broad acceptance of New Space, NASA recently selected SpaceX to build the next Human Lander System (HLS) to take US astronauts to the surface of the Moon, including the first woman and the next man as part of the NASA Artemis Program. Today, the commercial space ecosystem in the USA is very different and more vibrant than at any time in the past. In 2000, Jeff Bezos founded Blue Origin, in 2002 Elon Musk founded SpaceX, and in 2004 Richard Branson founded

Virgin Galactic (in 2017 he founded Virgin Orbit). Together with hundreds of smaller space start-up companies in the US and around the world, this new generation of commercial providers of access to space and space services is

generally referred to as New Space. As evidence of the broad acceptance of New Space, NASA recently selected SpaceX to build the next Human Lander System (HLS) to take US astronauts to the surface of the Moon, including the first woman and the next man as part of the NASA Artemis Program https://www.nasa.gov/specials/artemis.

On December 3rd, 2021, NASA announced the winners of the Commercial Lower Earth Orbit (LEO) Development Program (CLD) study phase to build the next generation of privately funded space stations to replace the costly International Space Station (ISS): Blue Origin’s Orbital Reef, Nanoracks and Lockheed Martin’s Starlab, and Northrop Grumman. According to this program, NASA plans to become a customer of the commercial space industry and will no longer finance the expensive International Space Station (ISS). Almost two years before this announcement, NASA awarded Houston-based Axiom Space a contract to develop a commercial module that will be added to the ISS. In February 2022, the first generation of Axiom commercial astronauts on a joint NASA/Axiom mission called Ax-1 will start training at the ISS, preparing for operations on their (future) commercial space station.

All of these recently formed companies are part of the New Space ecosystem that is transforming, democratizing and commercializing space in a fundamental and impactful way. This should be for the betterment of all of humanity as we move towards becoming an interplanetary society that will build permanent settlements on the Moon and Mars, and source precious resources across our solar system. This technological evolution and maturation needs to be accompanied by a parallel evolution of the collective consciousness towards a peaceful, sustainable planet for all, and to protect other planetary bodies from contamination from Earth. One of the stated space policy priorities recently published by the White House in the “US Space Priorities Framework, December 2021”, states that “The United States will work with other nations to minimize the impact of space activities on the outer space environment, including avoiding harmful contamination of other planetary bodies.” This policy also includes the need for increased efforts to mitigate, track, and remediate space debris, and also to lead the international community in protecting Earth from potential harmful impacts by near-Earth objects.

The Role of the US Government and NASA

The US Government DOD and NASA space programs have had the explicit long-term goal to invest large resources to transition essential space capabilities and services, traditionally implemented by the US Government or prime contractors, into the broader New Space commercial sector, thus stimulating competition and economic growth. This topic remains a central part of the White House US Space Policy Priorities, to “…foster a policy and regulatory environment that enables a competitive and burgeoning US commercial space sector”. Notable NASA programs that implement this policy include:

- Commercial Crew & Cargo Program to replace the Shuttle program and service the International Space Station (ISS) with cargo and human-rated commercial vehicles.

- NASA Artemis to return astronauts to the surface of the Moon, including the first woman and the first person of color. The program includes development of the Lunar Gateway in cis-Lunar space as a permanent station in proximity to the Moon.

- Commercial Destinations in LEO program to create new destinations in LEO to supplement and eventually replace the ISS with commercial real-estate destinations managed and financed by the private sector.

- Commercial Lunar Payload Services to deliver scientific and other payloads to the surface of the Moon using a portfolio of commercial lunar landers: small, medium and large.

No other sovereign government or national space agency has explicitly pushed for the rapid

commercialization of space as has the USA through its civil and defense programs. This policy has been welcomed by founders and venture capital investors alike. The role of the government is critical to the growth of the commercial space industry: it provides non-dilutive grants through competitions; early-stage technology investments and licensing opportunities; risk reduction using in-space technology demonstrations; and being a first adopter of new commercial space products and services. The result is a booming commercial space industry that is heavily based in the USA, which is commercializing space at an unprecedented pace. The strategy is clearly paying off as the private sector is eager to leverage government investments and financial stimuli, while also supplementing these investments with venture capital which is accustomed to taking risk. This is often referred to as public-private partnerships and it is likely to increase in the coming years in the USA, as it is clearly a strategy that has bipartisan support in the US Congress and the public.

Key Enablers of Growth of the Space Economy

It is fair to ask, ‘Why now?’ Just as has been recorded in other fields such as the semiconductor industry or the rapid adoption and growth of the worldwide internet, there are usually multiple factors that, when combined together in time and space, and with the right stimulus, result in the rapid adoption and exponential growth of an industry. In the case of the US space industry, the landscape for rapid growth has been seeded, over many decades, by consistent government research and development investments. With the proactive government policy to create competition and stimulate a diverse and sustainable private sector, the space industry is poised for rapid growth and commercialization.

We discuss five factors that have enabled the rapid growth of the space industry: 1. reduced cost of access to space; 2. emergence of satellites as a commodity; 3. the maturation of data analytics, artificial intelligence and machine learning; 4. innovation in space, as entrepreneurs offer new solutions with existing technologies; and 5. venture capital ready to invest and take risk.

- Reduced cost of access to space

This is perhaps the most important factor of all. From the 1970s and into the early 2000s in the USA, access to space was limited to the US Government via the government-funded Space Shuttle Program, this is perhaps the most important factor of all. From the 1970s and into the early 2000s in the USA, access to space was limited to the US Government via the government-funded Space Shuttle Program, and by commercial contractors such as LM (Atlas), Boeing (Delta), or Orbital (ATK, now NGC). LM and Boeing later merged their launch services divisions into the United Launch Alliance (ULA) in order to reduce cost and share the small market offered primarily by the US Government, civil and military. At that time, the lion’s share of the international launch vehicle business was in the hands of Russia’s Soyuz launch vehicle. The rest was shared by ULA (USA), Orbital ATK (now NGC), Arianespace (ESA), ISRO (India) and China. Enter Elon Musk with SpaceX in 2002 with a bold vision of reusable rockets that will significantly reduce the cost of access to space. Two decades later, SpaceX dominates the launch vehicle market share with 22% in 2020. Moreover, the cost of access to space, measured as the average cost per kilogram, has plummeted from roughly (multiples of) $100,000, to (several) $1000. SpaceX is not alone in this pursuit. Recently, the USA has gained three additional launch vehicle providers that have successfully launched payloads into space: Rocket Labs, Virgin Orbit, and Astra. Moreover, there are more start-up companies ready to launch in the coming months including FireFly Aerospace, Relativity Space, and ABL. Even more early-stage companies such as Stoke and Radian Aerospace1 are in the pipeline to disrupt the launch vehicle market and further reduce the cost of access to space.

SpaceX’s Starship launch vehicle

The net effect is that the options for access to space have grown significantly across a wide range of payload sizes from very small nanosatellites and CubeSats (1 – 100 kg), to small (100 – 300 kg) and medium-sized spacecraft (300 – 600 kg). This is fueling competition and reducing the overall cost of access to space. This trend is expected to continue in the coming decades even if some consolidation and attrition occurs in the marketplace.

2. Small Satellites, CubeSats and more

Over the past thirty years, the US Government, academia and the space industry have witnessed the steady but lasting adoption of small satellites (< 300 kg) for space science, commercial applications and defense services. Small satellites are here to stay and will continue to grow in functionality and reliability and at reduced cost. They do not replace or compete with all large spacecraft systems where physics (such as large collecting apertures) dictates the size of the spacecraft. This technology trend towards smaller and more effective satellites is fueling innovation and allowing start-up companies, universities and even high schools to launch their own micro (< 100 kg), nano (< 10 kg) or even pico (< 1 kg) satellites for educational purposes.

Over the past decade, multiple constellations of large numbers of low-cost small satellites in LEO have been successfully deployed. This is in direct competition with the more traditional approach of using a few larger geostationary (GEO) spacecraft. First to do this on a large scale was Planet Labs (2010) which currently operates over 600 satellites in LEO for continuous and global imaging of Earth on a daily basis. SpaceX and OneWeb have each deployed their own constellations of small satellites in LEO to provide broadband internet services around the world. Spire did the same for weather monitoring services on a global scale. Umbra and Capella provide RADAR imaging, and many more constellations of small satellites in LEO are getting ready to launch. In the near future, Amazon plans to launch its Kuiper large constellation to also provide broadband internet services across the globe. Behind this revolution in spacecraft miniaturization and capabilities are decades of research and development funded by the NSF, NASA, DARPA at national laboratories (JPL, ARC, Aerospace Corporation, AFRL, etc.) and at universities: Cal Poly San Luis Obispo, MIT, Stanford University, UCLA, USC, Univ. of Michigan, Purdue University, Univ. of Texas, Austin, and many more.

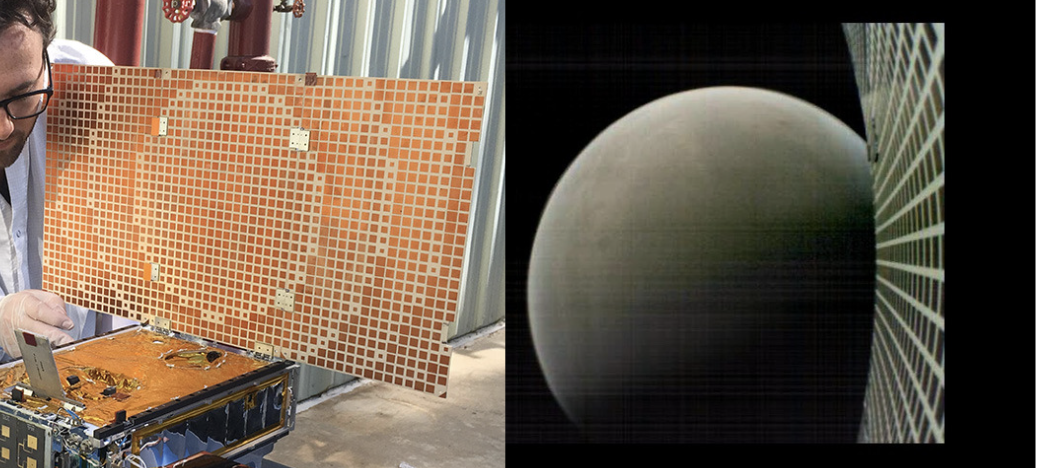

In May 2016, the National Academies of Sciences, Engineering and Medicine, Space Studies Board, Division on Engineering and Physical Sciences, chaired by NASA Associate Administrator for Space Science, Professor Thomas Zurbuchen, published a seminal study called “Achieving Science with CubeSats: Thinking Inside the Box” The National Academies Press. The report spells out the significant space science opportunities enabled by CubeSats of different sizes and their use in large numbers such as constellations and other forms. The role that NASA and the government can play for the community has also evolved in terms of buying down risk, developing new technologies and doing first of a kind space science missions using CubeSats. In 2018, NASA flew a pair of CubeSats as part of the MarCO mission, which provided valuable relay service at Mars for the successful landing of the INSIGHT lander on Mars. These CubeSats were the first interplanetary CubeSats to fly by another planet, thus encouraging many to follow to explore CubeSat missions to the Moon, Mars, asteroids and beyond.

MarCO CubeSat that flew past Mars and performed a valuable relay service for the successful landing of INSIGHT lander on Mars. Credit: NASA/JPL

Since 2013, NASA established the Small Spacecraft Systems Virtual Institute at the Ames Research Center in Palo Alto, California, which publishes the Small Spacecraft Technology – State of the Art Report each year https://www.nasa.gov/smallsat-institute/sst-soa. According to the recently released 2021 report, “In 2013 alone, around 60% of the total spacecraft launched had a mass under 600 kg, and of those under 600 kg, 83% were under 200 kg and 37% were nanosatellites. Of the total 1,282 spacecraft launched in 2020, 94% were small spacecraft with an overall mass under 600 kg, and of those under 600 kg, 28% were under 200 kg, and 9% were nanosatellites. Since 2013, the flight heritage for small spacecraft has increased by over 30% and has become the primary source to space access for commercial, government, private, and academic institutions.” A detailed report of all the satellites including small satellites launched, is published by BryceTech “SmallSat by the Numbers, 2021” at: Reports.

It is fair to point out that this revolution in spacecraft cost and size is not without its challenges. For example, there have been more recorded failures of CubeSats in space than has been recorded in the past by more traditional spacecraft suppliers. Whereas they are cheaper to build, they are often less reliable and typically lack redundancy or built-in safety features, making them prone to failure in the harsh space environment. Even so, small and nanosatellite providers have been able to adapt and further improve performance by using innovative solutions and new technologies such as: deployable structures for antennas and solar arrays; building in reliability at the system level using multiple spacecraft; using commercial off-the-shelf hardware and software systems; and finding innovative ways to mitigate failures due to radiation exposure in space using software techniques, new coating materials and more

3. Rise of Data Analytics, AI and ML

Fortunate for the growing space industry is the synergistic growth of the fields of data analytics, artificial intelligence (AI), and machine learning (ML). These are disciplines that have matured over the past thirty years from basic research at universities to applications by industry. With the proliferation of spacecraft due to reduced cost of access to space and the reduction of cost of small spacecraft, we are now inundated with enormous volumes of data from a plethora of constellations in LEO. Without the right tools for data analysis, users are left to struggle and navigate the raw data. Users need and require actionable information and knowledge, not volumes of data. For example, a wine grower would benefit from knowing the right time to pick grapes based on their sugar content. They would also benefit from having local and global situational awareness on other wineries for the purpose of trading in the open market. In any case, they would welcome more reliable and precision weather prediction models to protect their investments. The same example can be given for farmers in the field deciding on what, where, and when to plant and when to harvest. All this information is accessible from space but has to be translated into a language and format that a user can understand and act on. The number of applications of observational data from space is endless both for civil and defense applications and is growing each year. Observational data of Earth from space is also essential for monitoring Climate Change, for providing healthcare services in remote locations especially in Africa or Asia, critical to weather monitoring and disaster management, national security and situational awareness, military applications, and more. In the coming years, it is natural to expect a rise of innovative start-up companies and entrepreneurs who will focus on data assimilation and analysis, focusing directly on the user, and buying data from all suppliers as needed and as available. This marketplace of converting volumes of raw data into actionable information and knowledge will further stimulate innovation and applications for the benefit of all.

4. Innovation in Space

A key factor fueling the emerging New Space industry is innovation. Key enabling technologies for the exploration of space are still generated within US Government laboratories: NASA’s JPL, GSFC, ARC, JSC or GRC; DOD’s Aerospace Corporation or ARFL; DOE laboratories such as SNL or LLNL and many more. There is no way that a start-up company can compete with the US Government in spending, for example, $100M over multiple years on basic research to pioneer a new class of space detectors, new and improved nanomaterials, new propulsion technology, or a new navigation device. Start-ups need to license these technologies from the US Government or universities and then apply their own entrepreneurial talent and innovation to create new systems. Whereas the US excels in this department compared to the rest of the world, it could do more to facilitate technology transition from government and academia to industry. Moreover, the US could partner with industry to allow start-ups to use national facilities when they are not used by the government. The benefit to the government is obvious, as innovations in space by private industry will return in the form of lower cost contractors to the government.

It should be pointed out that space innovation is not unique to the USA. Most notably, universities such as Cambridge, Oxford, University College London and Imperial College in the UK, have excellent space innovation centers that are sourcing numerous start-up companies in space. The same can be said of other European universities in Italy, France, Spain, Germany, Ukraine, Russia, Lithuania and more. In Asia, China, Japan and India stand out, as well as Australia, New Zealand and Singapore. In the Middle East, Israel, the UAE, Qatar and Saudi Arabia have active entrepreneurial space programs. In each of these countries there is a solid educational system and very talented young founders in the making, looking for opportunities to contribute to the emerging space economy.

Innovation in space is also stimulated when parallel fields of development are leveraged by the space community, as is the case with Data Analytics and AI. Other areas where this is taking place is in the area of commercial microelectronics where advanced semiconductor foundries such as the TSMC are fabricating chips that are, by design, more resilient to some radiation effects in space, such as Total Ionizing Dose (TID). For example, the microcontroller powering the Ingenuity Helicopter on Mars, is sourced by Qualcomm’s Snapdragon microcontroller which is a commercial product screened for use on Mars. This helicopter was the first ever use of an aerial mobility platform on an alien planetary body, a Kitty Hawk moment for the history books.

Another area of innovation and application to space is the field of Cloud Computing and Software as a Service (SaaS). Whereas this model of business is old news on Earth, it is new to space and is expected to grow in the coming years. Companies such as Slingshot, Kubos, Epsilon3, and Continuum Space Systems (CSS)1 are examples of what is being referred to as Digital Space and Space as a Service. In these cases, digital platforms hosted in the cloud by Amazon Web Services (AWS) or Azure are used to provide space services to the growing space community.

Innovation centers are emerging not only in close proximity to universities such as MIT, Univ. of Colorado, Purdue or Michigan, but also in the form of space-themed incubators and accelerators. TechStars, Starburst, Y-Combinator, Creative Destructive Laboratory (CDL), Seraphine, BoomVC and Mandala Space Ventures1 in Pasadena, California, are all examples of new incubators, accelerators or studio ventures that are investing in early-stage start-up companies that are entering the new space economy.

5. Venture Capital

It has been well documented in finance and banking (JP Morgan, Morgan Stanley, The Space Report, BryceTech and many others) that space is an emerging new market for investment using a broad range of investment vehicles from angel and seed investments to public markets via Special Purpose Acquisition Corporations or SPAC. Companies that have recently used SPAC as a vehicle for entering the public market include Planet, Spire, Virgin Galactic, Astra, RocketLabs, and many others. The number of VCs entering the business of space has skyrocketed (pun intended) and many of them are investing in early-stage companies at the pre-seed or seed rounds. Traditional large VCs with deep pockets are now joined by new emerging venture funds eager to find good deals and be the first to invest in high-growth/high-risk space enterprises. This is good for both founders and the business of space. The average size of the Seed and A rounds have grown significantly, as have company valuations, reflecting a market eager to find good deals and be the first to sponsor a new and talented founding team. Whereas the US is well known for its venture capital business, investment in space is not limited to the US. Active VCs in space exist in the UK, Singapore, the Middle East most notably the UAE, Israel, Japan and other countries. In the US, there are a few funds dedicated to the emerging space economy including Hemisphere Ventures, TechStars and the Explore1 Fund.

The Segmentation of Space by Destination

Three broad-based destinations are emerging for space economic development as follows:

- Earth Orbit (Lower, Medium, and Geostationary)

We are seeing an exponential growth of systems being deployed in LEO. This is fueled by two major application areas which are creating a ‘Gold Rush to LEO’:

a. Broadband Internet: OneWeb and SpaceX’s Starlink constellations represent just the beginning of the era of constellations of satellites for the sole purpose of connecting the world via high bandwidth internet services. Amazon’s Kuiper constellation is also planning to deploy a large constellation in LEO as well. Applications include entertainment, social media, economic transactions such as banking, electronic ledgers and blockchain, business-to-business and many others. The recent global Covid pandemic has also transformed the workspace and the balance between the need to go to work and working from home. This change has been enabled by broadband internet services and the appetite for more bandwidth at the consumer and business level is expected to grow further over the coming years and decades. Social media and entertainment content are contributing significantly to its growth. At the moment, all of these systems are using microwave (RF) communication systems, however, optical communication systems are rapidly entering space as well. Mynaric is a publicly traded company offering optical communications terminals for space, whereas Hedron1 and SkyLoom are emerging start-up companies planning to disrupt the marketplace in the coming years. These companies are also planning to build a constellation of satellites as communication infrastructure as a service, that will offer bandwidth as a service to existing constellations such as StarLink or OneWeb. Only a few days ago, NASA successfully launched the Laser Communications Relay Demonstrator (LCRD) mission to GEO to demonstrate optical communications between Earth and GEOspace. Next year, NASA will launch the Psyche mission to an iron-core asteroid and demonstrate Deep Space Optical Communication (DSOC) from the distance of the asteroid belt, back to Earth. NASA has also previously demonstrated optical communication from and to the Moon. So, optical communications are maturing to the point of commercial use.

b. Remote Sensing Remote sensing applications are generally divided into passive and active systems.

- Passive systems collect reflected signals such as sunlight from the Earth and turn them into images. Depending on the spectrum of observation they can use cameras in the visible spectral range as does Planet. Other constellations such as Satellogic collect multispectral or hyperspectral data that provide information about the composition of the observable target. Other companies such as GeoOptics use signals from existing satellites such as GPS to image the planet.

- Active systems use a signal generated onboard the spacecraft to bounce off the surface of the Earth and then receive the signal onboard the spacecraft. Examples include RADAR imaging (Capella, Umbra, or Iceye); start-up NuView, which proposes to use light (LIDAR) imaging to image the globe on a regular basis; and Spire, which uses Radio Occultation (RO) to send a signal through the atmosphere to another satellite and thus measure cloud coverage, precipitation and other weather conditions across the globe.

Each of the above active or passive observation platforms offer a different view of Earth and sometimes different views of the same target. A user application will likely benefit from multiple sources of data of the target as each gives different kinds of information.

In essence, LEO is already crowded and about to get even more crowded as existing constellations grow to full scale and as new constellations are launched. In a recent news article, Space News reported that multiple constellation providers filed with the FCC to bid for the new V-band spectral allocation to provide internet services around the world. In doing so, they filed for a total of 38,000 satellites. This does not include another 30,000 planned by SpaceX for Starlink. Therefore, it is reasonable to assume that over the next decade another 100,000 satellites will be deployed in LEO, driven primarily by the need for increased broadband and remote observation services. Whereas space is large, it is getting crowded, generating its own set of problems due to the rise of junk in space, space debris.

2. The Lunar Economy

Thanks to NASA’s Artemis Program, the USA has created an international coalition of space agencies to jointly construct a smaller version of the ISS at the Moon, called the Gateway. It will operate in cis-Lunar space, which permits human sorties to and from the Gateway to the surface of the Moon. The Gateway in cis-Lunar space represents another steppingstone in humanities ascent to becoming an interplanetary society and enabling the permanent settlement of the Moon. NASA has also selected Lockheed Martin’s Orion spacecraft to ferry astronauts to and from the Gateway, even though SpaceX has also developed the Dragon module to do the same.

In parallel to the Artemis Program, NASA’s Commercial Lunar Payload Services Program (CLPS) is incentivizing a broad sector of commercial space to develop landers, payloads, rovers, and other modules to be delivered to the surface of the Moon. NASA recently announced its selection of the small lunar lander from Intuitive Machines (IM) as the first in a series of landers to deliver payload to the surface of the Moon.

In the coming years, more contracts are expected to be awarded by NASA, providing a major stimulus to growing small business space communities. A number of applications and services have been identified to be available at the Moon as follows:

• Remote sensing resource prospecting from Lunar orbit;

• In-situ resource prospecting and utilization

• Creation of human habitats for long-term habitation on the Moon;

• Research parks and observational science stations for astrophysics;

• Power stations and power utility services on the Moon;

• Precision navigation and timing services on the Moon;

• Communication services between assets on the Moon and between the Moon and Earth;

• Manufacturing of propellant and fuel storage;

• Servicing the cis-Lunar economy, fuel depot;

• Launchpad for human mission to Mars;

• Training ground for astronauts and demonstrating sustainability on another planet;

• Space Tourism and education.

The Moon is also a possible and likely destination for the launch of large payloads to Mars including humans. The reason is that it is expensive (due to the Earth’s large gravity well) to launch large payloads from the Earth to Mars. However, if resources such as fuel were sourced and fueled in lunar orbit, then launching from the Moon (which has a much smaller gravity well) to Mars will be less expensive and more cost-effective. Refueling depots would then be placed in lunar orbit or cis-Lunar space; humans would station on the surface of the Moon, and when the vehicle is ready, dock with the interplanetary shuttle and go to Mars. The shuttle would then come back to the Moon for refueling and to pick up new passengers.

3. Mars, Asteroids and Beyond

Human exploration and the permanent settlement of Mars are within reach in the 21st century. Today, NASA has two one-ton nuclear-powered rovers (Curiosity and Perseverance) active on the surface of Mars and performing cutting edge scientific research.

Credits: NASA TV, Perseverance rover took its first image of Mars on February 18, 2021.

Moreover, the Perseverance rover is the first step in a three-part mission called Mars Sample Return, in partnership with the ESA, to return Mars samples back to Earth for scientific research. Technologically, the Perseverance rover and the Ingenuity Mars Helicopter are cutting-edge space technology, with ample opportunities for commercialization and applications in the emerging space economy. Perseverance’s MOXIE experiment demonstrated for the first time the ability to create pure oxygen from the Mars atmosphere, a critical step for future human habitation on Mars. Moreover, NASA has sponsored research at universities on how to create human habitats on Mars using local material and 3D printing technologies. This coupled with water resources on Mars, an (thin) atmosphere and gravity closer to what we have on Earth (than the Moon), makes human habitation on Mars even more technologically feasible than on the Moon. Using the Moon as a training ground for interplanetary travel, using it as a source of fuel, and using cis-Lunar space as a staging ground for reaching Mars, and ultimately permanently settling on Mars, will qualify humanity as an interplanetary society.

In addition to Mars exploration, NASA and the international space research communities are actively exploring asteroids in situ and via proximity observations. This is being done primarily to obtain scientific knowledge about the formation of our solar system and how life may have originated on Earth. Ongoing and upcoming NASA missions to asteroids include OSIRIS/REX, Lucy, and Psyche. In

addition, NASA recently launched the DART mission to an asteroid as part of a planetary defense demonstration. Today, the technology to source, rendezvous, sample, capture, and robotically return a small to medium-sized asteroid (10-20m) to the Earth-Moon system already exists, even though it has not yet been demonstrated. In the near future, commercial companies may be contracted by NASA to do so and provide precious samples for scientists to study, while retaining some agreed upon fraction of the extra-terrestrial resource for commercial use.

There is no doubt that this technology and service will be deployed in the 21st century as Planet Earth continues to grow in population and continues to deplete precious resources. There is no reason why we should not source scarce resources wherever we can, from the Moon, Mars, asteroids, and beyond. Our solar system has plenty of additional water captured in what are referred to as Ocean Worlds of our solar system. The moons of Jupiter including Europa, and of Saturn including Enceladus, have vast oceans of water below their icy crusts. NASA has already made significant progress towards fielding missions to Europa (Europa Clipper, 2024) and Titan (Dragonfly, 2027), the moon of Saturn which contains vast oceans of methane.

An integral part of becoming an interplanetary society will be the sourcing of extra-terrestrial resources from throughout our solar system which will stimulate an interplanetary trading infrastructure much like exists today on Earth.

Space Investment Verticals

Several space investment verticals are already emerging in the space industry. For example, Launch Vehicles as a sector is already formed with a pipeline of established public companies (LM, Boeing, NGC), private companies (SpaceX, FireFlies, Astra, Virgin Orbit and RocketLabs) and a set of emerging start-up companies (Relativity Space, ABL, Stoke, Radian Aerospace and more). Other verticals in formation include:

• Space Tourism.

• In-Space Manufacturing.

• Real Estate in Space.

• Space Infrastructure.

• In-Orbit Servicing, Assembly and Manufacturing (OSAM).

• Supply Chain in Space.

Space Tourism is quickly transitioning from ‘in the future’ to ‘now’; from ‘the billionaires club’ to the ‘luxury tourism’ industry. Besides the recently well-publicised Blue Origin and Virgin Galactic suborbital flights, other companies are developing infrastructure to support the growing demand and appetite for space tourism. Axiom Space and other commercial real-estate providers in space are counting on tourism as one of their main growing business sectors, as they develop real-estate in space. A weekend getaway to LEO is not too far away. Other forms of tourist attraction will include a sortie from the space station; a trip to circumnavigate the Moon and back; time at the Lunar Gateway, or even time on the surface of the Moon. Companies such as Space Perspective1 are counting on the growing demand for space tourism as they offer a view of space using high-altitude gondolas at a fraction of the current price of going into orbit, thus further democratising the New Space ecosystem.

In-Space Manufacturing is another fast-growing field in the space industry. Companies such as Varda and Space Tango are developing in-space manufacturing services and capabilities that offer the unique microgravity environment to manufacture innovative products that cannot be manufactured on Earth. Examples are plentiful in the fields of pharmaceuticals, bioengineering, healthcare, semiconductors, metallurgy, and more. From the early years of manufacturing on Earth, we have been confined to building systems in Earth’s gravity. Space now offers a new vantage point that we have not used before, other than on the ISS, for basic research available to only a few universities or government laboratories.

Real estate in space is rapidly evolving into a distinct ecosystem and a clearly investable marketplace. The lead was taken by Axiom Space, but now Blue Origin, Nanoracks and NGC have been selected by NASA to perform a phase one study for developing a commercial space station where NASA can become a tenant. It is only a matter of time before there are other entrants into the space real-estate business. These venues will provide a location for applications such as space tourism, in-space manufacturing, astronaut training, R&D, government services and more.

• Optical communications between satellites and between LEO and Earth to supplement the

growing system of constellations that are bandwidth limited. Emerging companies in this field

include: Hedron, Skyloom, Mynarec, SA Photonics, and others. Optical communications, as

opposed to microwave communications, has the potential to provide higher bandwidth and to

provide more secure communication between satellites, compared to microwave-based

systems.

• In-space computing and storage centers.

• Refueling depots.

• In-space transportation.

On-Orbit Servicing, Assembly, and Manufacturing (OSAM) is a fast-growing field that is of dual use, with both commercial and strategic applications. A multi-agency working group has been formed in the US to coordinate and stimulate this sector of high value to the space economy. This field includes servicing existing assets in space, assembling larger structures from smaller building blocks such as large telescopes or complex systems, and using technologies such as 3D printing to manufacture components in space that can then be used to service or replace failed parts.

Supply Chain in Space refers to the growing service industry that needs to emerge as part of the end-to-end mission supply chain. This includes subsystems such as advanced propulsion, thermal, structural, power, communications, avionics, and payload and software systems for mission operations. It also includes spacecraft systems which are evolving very quickly.

Protecting Planet Earth

One of the leading topics today of great concern to the general public is Climate Change. What are we doing to protect and help our planet heal? There is no doubt in the scientific community that human factors are a significant contributor to climate change and that there is a need for urgent and immediate action. In fact, some scientists claim that the damage caused so far is so broad and devastating that it will take many centuries or even millennia to reverse the damage, even if we were to immediately halt all human-generated carbon emissions. According to this view, only proactive regenerative solutions such as carbon capture, provide a credible path forward. In any case, there is also no doubt that scientific observations from space are critical to our continued understanding of what is happening on our planet. A series of Climate Change-related missions is in the process of being implemented, including Carbon Mapper, MethaneSat, HydroSat, and many more. Each mission uses the unique vantage point of space combined with special remote sensing instruments such as hyperspectral imaging or thermal infrared spectroscopy to image Earth and provide new information related to Climate Change. These missions are intended to complement existing NASA missions to observe Earth and collect scientific data.

According to the latest National Academy of Science (NAS) Decadal Survey for Earth Science: “Thriving on a Changing Planet”, published in 2018, Thriving on Our Changing Planet: A Decadal Strategy for Earth Observation from Space, one of the key challenges in the observational field of Planet Earth is to understand Earth as a single system, the ocean and sea-level rise, mass change, cloud formation and precipitation, and how all these combined act as the single system we call Planet Earth. We need to proactively monitor, protect, and preserve our land, ice, waters, air, and space, in order to be both responsible custodians of Planet Earth and to also learn how to protect other planetary bodies such as the Moon and Mars.

Today, Earth’s LEO is littered with space junk, and the problem is getting worse every year. There is even a US Space Policy Directive (SPD-3) issued by the USA National Space Council (NSC) to actively solve the problem of space junk, or orbital debris. This is a threat to both doing business in space and to the broader space economy in LEO. The recent demonstration by the Russian Space Agency (ROSCOSMOS) hitting one of its own defunct satellites in LEO resulted in substantial orbital debris that is a problem for all. China made a similar demonstration using one of its own satellites in 2007. As the number of operational satellites in LEO grows exponentially to over 100,000 in the next decade or two, there will have to be an active process and indeed a set of commercial services to proactively locate, rendezvous, capture, and actively remove debris from space. New rules are in place already by the FAA to make sure constellation providers have designed their systems with enough resources to deorbit and burn up in the Earth atmosphere. This is a move in the right direction. Companies like LeoLabs have built commercial RADAR systems to actively monitor space debris and provide an early warning system to satellite operators. Other companies such as AstroScale and Starfish, and Rouge Space plan to provide services in LEO to remove orbital debris.

Another important area where space can and will provide significant benefits to humanity is disaster prediction, monitoring, and management. This includes weather predictions and monitoring, support for first responders, information management during disasters, flood predictions, fire risk assessment, fire monitoring and fire management, and more. Space can also support healthcare providers in Africa, Asia, or South America. Many diseases such as malaria are strongly correlated with weather conditions on Earth and this information can be used to prevent the spread of disease.

Towards an Interplanetary Society

As a society, over the past century, we have made amazing scientific discoveries and deepened our understanding of how nature works and behaves, starting from the Big Bang some 13.8 billion years ago, until today. The basics of cosmology and the observation of distant galaxies have unique touchpoints with fundamental particle physics, the pursuit of knowledge how matter was created from energy and how we ultimately evolved into the intelligent species we are today, inhabiting Planet Earth in the goldilocks region in our Solar System in the spiral Milky Way galaxy.

However, as a society, we are plagued by collective human behaviors that should make us pause and wonder, ‘who are we, really?’ and, ‘are we responsible enough?’ to expand our ways of living and cohabitation to other planetary bodies. Technologically, we are ready to expand to the Moon, Mars, and beyond within this century. However, we must improve our collective behavior and demonstrate a planetary level of consciousness for the betterment of all humanity. This is perhaps our biggest challenge towards a sustainable interplanetary society. The United Nations (UN) and NASA’s Artemis Program are making formidable steps in this direction, defining basic principles of international and interplanetary norms such as the peaceful exploration and utilization of space for all, equality, inclusivity, transparency, emergency support and more. We need to protect not just Planet Earth but also all other planetary bodies as we settle them for the benefit of humankind

Share